* EBITDA(Earnings Before Interest, Taxes, Depreciation, and Amortization)

1. 25-27 MTP

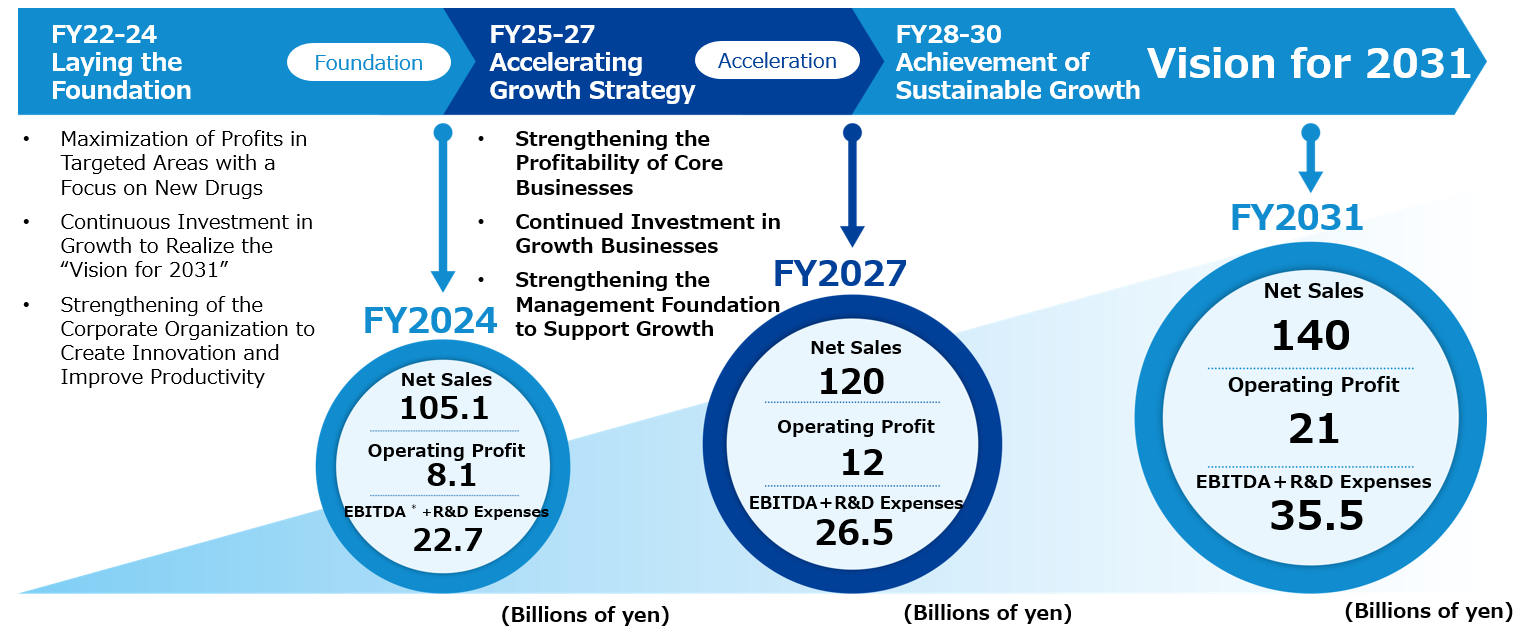

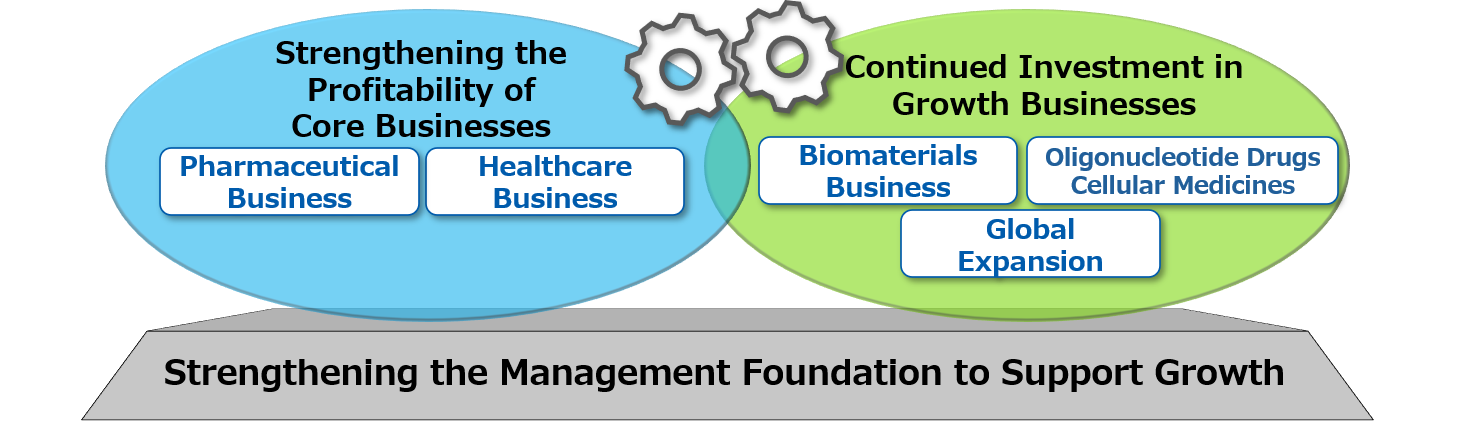

To realize the "Vision for 2031," Mochida Pharmaceutical Group has developed 25-27 Medium-term Management Plan, hereinafter 25-27 MTP, as an action plan for the issues to be addressed over the three years from FY2025 to FY2027 from the perspective of the sustainable enhancement of corporate value. "22-24 Medium-term Management Plan" that started in FY2022 was positioned as a "three years of laying the foundation," and we focused on themes of creating innovation and improving productivity. 25-27 MTP is positioned as "three years to accelerate growth strategy." We will focus on three key themes: strengthening the profitability of core businesses, continued investment in growth businesses and strengthening the management foundation to support growth. Since profit contributions from growth businesses are expected after FY2028, the core businesses will support growth during the 25-27 MTP period.

2. Three Key Themes

1) Strengthening the Profitability of Core Businesses

- Pharmaceutical Business

We will strengthen profitability by maximizing the product value of five major new drugs*1 and expanding the pipeline through in-licensing. Additionally, we will aim to increase our net sales by striving for further value enhancement of flagship drugs*2 and expansion of biosimilars.

*1 Urece, Omvoh, Cortiment, Goofice, Treprost

*2 High Purity EPA formulation, Dienogest formulation

- Healthcare Business

We will establish two major brands, Collage Furfur and Collage Repair, and strengthen profitability through the expansion of our product lineup and optimization of the sales network.

2) Continued Investment in Growth Businesses

- Biomaterials Business

We will secure revenue through early market launch while simultaneously working on developing our business foundation and improving productivity. - Oligonucleotide drugs

We aim to become a leading company in siRNA drugs with the ability to continuously develop siRNA drugs of high medical value. - Cellular Medicines

Aiming for early commercialization, we will collaborate with companies that possess knowledge and technology related to regenerative medicines for each type of cells, and advance research and development and the establishment of manufacturing systems. - Global Expansion

We will enhance cross-organizational collaboration centered around International Business Development Department and advance overseas development focusing on Epadel, Dienogest formulation and the biomaterials business.

3) Strengthening the Management Foundation to Support Growth

- Financial Strategy

We aim to balance the improvement of profit levels with future investments, targeting enhancements in ROE and PBR. Regarding cash allocation, we plan a cumulative total of 36 billion yen for research and development expenses in the pharmaceuticals, biomaterials and healthcare businesses, and 5 to 10 billion yen for capital investments to rationalize and automate pharmaceutical production and research facilities during the 25-27 MTP period. - Efficient Use of Human Resources and Infrastructure

We will promote organizational culture transformation, strengthening our human resource management system and facilitating the active participation of diverse human resources. Additionally, we will also work on improving the infrastructure that supports our management foundation. - Stable Supply of Appropriate Quality Products

We will properly implement product quality management and also work to strengthen manufacturing capabilities.

3. Management Goals

Through a growth strategy that utilizes both core businesses and growth businesses as two key components, we aim to achieve total net sales of 120 billion yen and an operating profit of 12 billion yen in FY2027. Furthermore, as a management indicator, we will use "EBITDA + Research and Development expenses," which is a resource for future growth, aiming for 26.5 billion yen for FY2027.

| KGI | FY2024 Results |

FY2027 |

FY2031 |

| Net Sales | 105.1 billion yen |

120 billion yen |

140 billion yen |

| Operating Profit | 8.1 billion yen |

12 billion yen |

21 billion yen |

| Research and Development Expenses |

11.6 billion yen |

12 billion yen |

12 billion yen |

| EBITDA+Research and Development Expenses |

22.7 billion yen |

26.5 billion yen |

35.5 billion yen |